Your little one deserves the understanding and Importance of Saving. Being a parent, you should teach your child the importance of money and saving. It will build a habit of saving money and helps in teaching your child the great power of investing money.

You might think that my child is too small to learn all this concepts or there is enough time for him/her to involve with the money. Actually, it is very good for them to understand the value of money and investment at the childhood age as it have few benefits for them, like Importance of saving money, benefits of investing, planning the surplus money or pocket money to manage efficiently. Children are capable to understand the value of money and finds it interesting to save the money.

Kids enjoy to take it as a fun or game using piggy banks, saving money received from elders and relatives in the Bank Accounts, Investing them and planning their futures.

There are two things -

- Age does not matter while introducing your child with money, investment and savings. As far as your child understands Pocket money or things to be available with money, you can start introducing your child with the money.

- Money can buy them cool stationeries, toys, games, their favorite food or anything they like. It will encourage them to save and finding ways to grow the money they have in their piggy bank or with the parents.

I would like to introduce you with the two concepts -

- Bank with Family

- Saving Account

You can give your child a banking concept at your home. Let me explain this, Grandparents or any or the parent can become the banker in the home for your child. Your child can give you their pocket money or money they received from relatives, elders to save on their behalf and you can attract them towards this by giving some incentive, like bonus or interest on their consistent habit of saving. This will encourage your child to save money and help them in understanding the concept of money management or somewhat called as investment which is growing at home.

Another way is to open a children saving account for them with a bank and explain them the benefit of interest on their saving. Nowadays, banks are offering good interest rate on minor saving account and other benefits like insurance, free withdrawal, capping on withdrawal, etc.

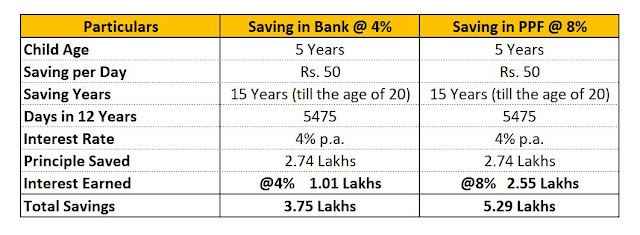

You might think that what is the relevance of saving small money and helping the child to understanding the money but this is the biggest step you are giving to your child for their life. You will actually give your child a good habit and sense of interest on the saving. Moreover, these small savings turns into a huge amount after a significant amount of time. Let us understand this also with an example stated below -

Above both the examples are evident to give a sense on the importance of saving a small amount, with a sum of as low as Rs 50 per day, you can save a maximum risk free sum of 5.29 Lakhs in 15 years. This is a big amount considering the importance of saving small amount consistently.

Encourage your child during this lockdown and teach them some value of money, saving and investment.

*Disclaimer : Interest rates are taken for example and indicative. It may be changed from time to time as per govt, banking and regulatory policies.

Happy Learning !!!

Comments